- 청년도약계좌 정부기여금, 금리별 만기 수령액 계산 (4.5% + @) - 부동산 가이드

- 청년도약계좌는 5년 만기 적금으로 청년이 내는 돈과 정부가 지원하는 돈을 합쳐 매달 최대 70만 원 납입 시 5년 후 5000만 원을 다 갈 수 있는 정책금융상품입니다.

Young adults starting their careers often grapple with the question of how to balance spending and saving.

This article will explain the Youth Leap Account, a government program designed to help young people transition more smoothly into society.

1. What is the Youth Leap Account?

- This policy-based financial product supports young people in building long-term assets. For five years (60 months), you can make contributions up to 700,000 won per month. The government provides a contribution of up to 6% per month, and the interest income is tax-exempt.

2. What are the eligibility requirements?

1) Age: As of the account opening date (enrollment date), you must be between 19 and 34 years old. Military service periods (up to 6 years) are excluded from the age calculation.

2) Personal Income: Your total annual salary in the previous tax year must be 75 million won or less, and your comprehensive income subject to income tax must be 63 million won or less. (However, this excludes tax-exempt income other than childcare leave pay and childcare leave allowance).

- If your income is verified during a period when the income for the previous tax year has not yet been finalized, the income of the year before the previous tax year will be recognized.

3. Household Income: Your household income must be 180% or less of the median income for your household size.

- If your income is verified during a period when the income for the previous tax year has not yet been finalized, the income of the year before the previous tax year will be recognized.

- Household members are defined as the applicant, their spouse (as per their family registration), parents, children, and siblings (minors).

4. Important Notes

- Only one account per person is allowed across all participating banks.

- If you are currently enrolled in the Youth Hope Savings Plan, you are ineligible.

- If, at the time of enrollment, the comprehensive financial income tax for the previous tax year has not been finalized and only the comprehensive financial income tax for the year before the previous tax year has been confirmed, the contribution will be suspended from the time the applicant is confirmed as subject to comprehensive financial income tax for the previous tax year. If found to be fraudulent in accordance with the Act on Prevention of Fraudulent Claims of Public Finances and Recovery of Unjust Profits, penalties such as recovery may apply.

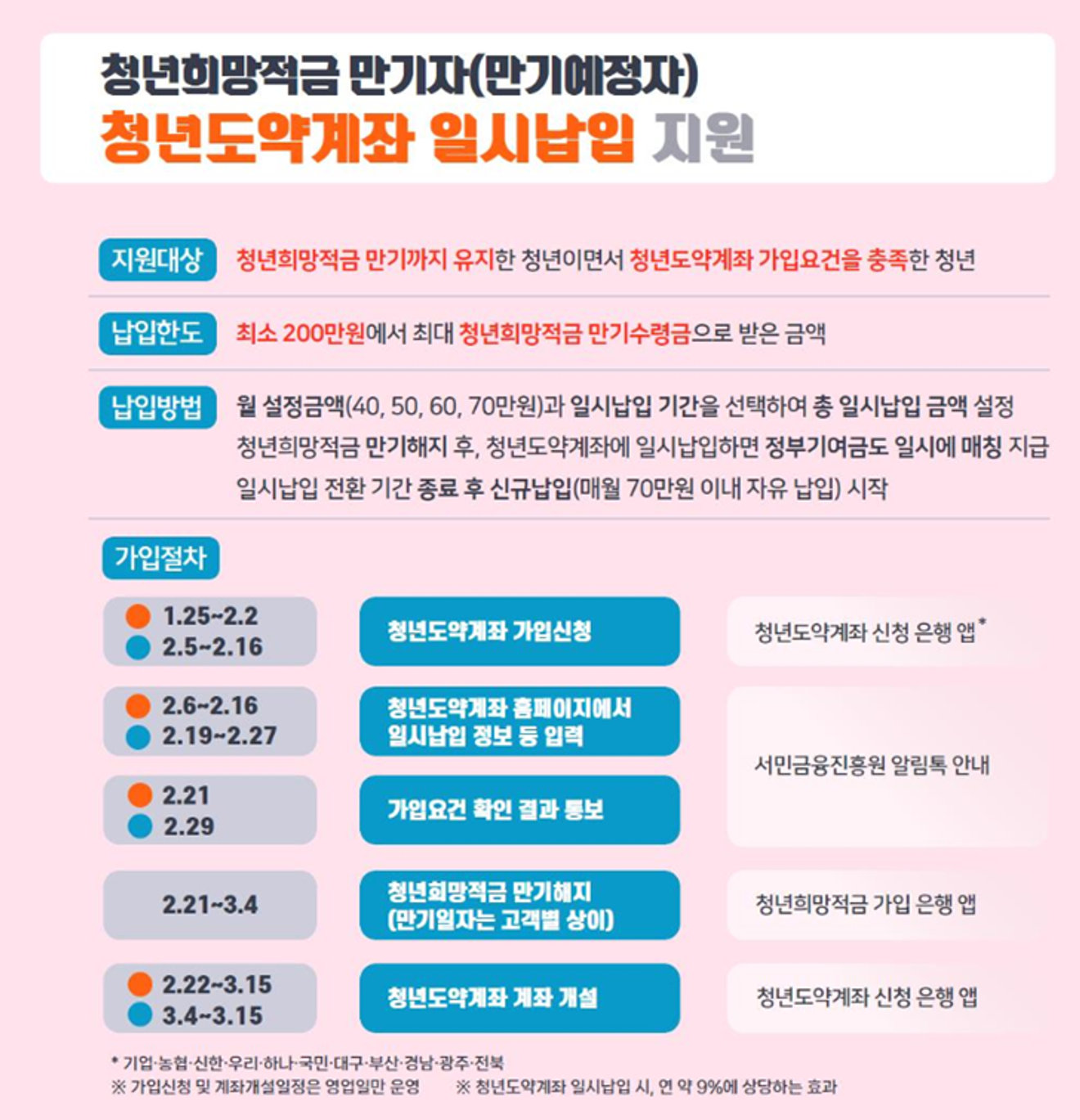

5. Youth Leap Account Lump-Sum Payment Support

- This program is for young people who have maintained their Youth Hope Savings Plan until maturity and meet the eligibility requirements for the Youth Leap Account.

- Participating Banks: IBK, NH Nonghyup, Shinhan, Woori, Hana, KB Kookmin, Daegu, Busan, Gyeongnam, Gwangju, Jeonbuk Banks

- If you deposit the maturity amount of the Youth Hope Savings Plan into a newly opened Youth Leap Account, you can receive an annual interest rate of approximately 9%.

However, the five-year period and the need to regularly deposit up to 700,000 won may be a burden. Still, those who have matured their Youth Hope Savings Plan can make regular transfers without worry for about 17 months!

- While it's a good program, the five-year savings period can be challenging. We encourage you to carefully consider your circumstances before applying.

Starting February 22nd, there will be an event for those who enroll through linked lump-sum payments. Those interested should check the announcement on February 22nd for event details.

Comments0